By Katharina von Plettenberg

The fashion industry is undergoing a significant digital transformation, with boundaries between online and physical retail becoming increasingly blurred. Technology is changing the way people discover, try on and purchase clothing. This change has been accelerated by the COVID-19 pandemic, which has led to a sharp increase in online shopping and digital interaction with brands.

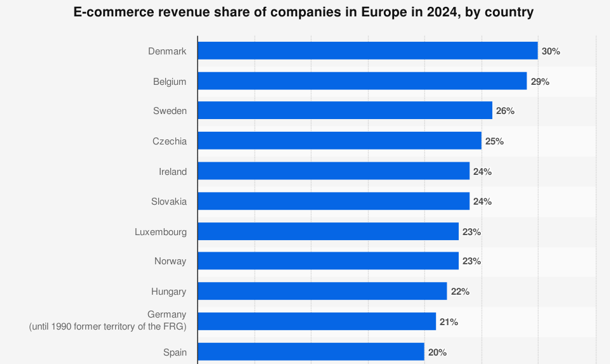

Online fashion retail has grown significantly across Europe, but its dominance is far from uniform. Smaller Northern European markets now handle around a quarter to a third of retail sales online. For example the e-commerce share in Denmark is around 30% (Statista, 2024). In Germany, online sales in fashion retail more than doubled between 2017 and 2024, rising from around 40 billion euros to over 100 billion euros. Nevertheless, physical retail remains remarkably resilient (d.velop, 2024). During the peak of the e-commerce boom in 2020, online sales only accounted for around 16% of total retail sales in Germany (d.velop, 2024). As the effects of the pandemic faded out, this share even fell to around 13% by 2023, which shows that the majority of purchases were still made in shops (d.velop, 2024).

E-commerce offers obvious advantages in the fashion industry, such as convenience because you can order just by one click, a wide range of products and competitive prices. However, it lacks the sensory and social experience of shopping in stores (Kovács & Keresztes, 2024). Customers value the chance to see and feel garments, try on outfits, and enjoy the instant gratification of taking items home immediately. Indeed, the ability to physically examine or test products remains a key unique selling point of traditional fashion retail (d.velop, 2024). It is the enduring strengths of a personal shopping experience that explain why physical fashion retailing has retained a central role, even as online retailing grows.

Nevertheless, physical shops are continuing to transform. Fashion retailers in Europe and Germany are investing in technology that combines the convenience of online shopping with the experience of shopping in-store. Rather than simply acting as points of sale, shops are becoming hybrid spaces enhanced by technology. For example, retailers are using mobile applications and connected devices in their shops to improve the shopping experience (McKinsey & Company, 2022). These include in-store apps for customers and shop assistants to interactive, intelligent mirrors in changing rooms. Such tools can optimise the in-store experience by providing customers with instant access to product information and reviews, helping them to find items in stock and offering personal styling advice while they explore the store. Conversely, companies are also using technology to transform shops into local fulfilment centres. Micro-fulfilment systems and inventory analytics enable physical stores to integrate into distribution networks as digital hubs, enabling online orders to be fulfilled from nearby stores and making better use of store inventory. This effectively merges online and offline stores into one cohesive system (McKinsey & Company, 2022).

One example of how digital technologies are integrated into physical fashion retail can be seen in the flagship store of Hugo Boss in Düsseldorf. As part of the company’s efforts to enhance in-store service through innovation, 8 of the 17 fitting rooms have been equipped with a newly developed smart fitting room system. This technology allows customers to access detailed product information directly on a screen, including fabric composition, care instructions, and available sizes. Using RFID (Radio-Frequency Identification) sensors, the system automatically identifies the garments brought into the fitting room and displays them on the digital interface. Shoppers can then request alternative sizes or seek assistance from sales staff without leaving the fitting room. This setup enables a more seamless and personalized shopping experience, blending the convenience of digital interaction with the benefits of in-person retail service (HUGO BOSS, 2024).

Beyond personalization, immersive technologies are adapting retail to the digital lifestyles of modern consumers. Augmented reality (AR) is a prime example. AR tools allow customers to try on products virtually (Kovács & Keresztes, 2024). Major fashion brands have introduced features such as virtual fitting rooms and AR try-on apps. Examples include Mister Spex’s online virtual try-on of glasses and Adidas’s AR shoe try-on feature. These initiatives boost customer engagement and loyalty, reduce return rates and increase sales by helping shoppers to make informed decisions in a fun and interactive way (Kovács & Keresztes, 2024).

The ongoing integration of digital technologies into fashion retail shows that the future of shopping will likely not be purely online or offline, but a seamless blend of both. As customer expectations evolve, success will depend on how well brands manage to connect convenience, personalization, and physical experience into one coherent journey.

Would you rather buy clothes in a shop or online?

Bibliography

d.velop. (2024). Zukunft des Einzelhandels: Was erwartet den stationären Handel von morgen? https://www.d-velop.de/blog/branchenprozesse/zukunft-des-einzelhandels/

Hugo Boss. (2024). HUGO BOSS opens BOSS flagship store and showroom in Düsseldorf. https://group.hugoboss.com/en/newsroom/news/news-detail/hugo-boss-opens-boss-flagship-store-and-showroom-in-duesseldorf

Joy, A., Zhu, Y., Peña, C., & Brouard, M. (2022). Digital future of luxury brands: Metaverse, digital fashion, and non-fungible tokens. Strategic Change, 31(3), 337–343. https://doi.org/10.1002/jsc.2502

Kovács, I., & Keresztes, É. R. (2024). Digital innovations in e-commerce: Augmented reality applications in online fashion retail—A qualitative study among Gen Z consumers. Informatics, 11(3), 56. https://doi.org/10.3390/informatics11030056

Statista. (2024). Share of e-commerce revenue among companies in selected European countries in 2023. https://www.statista.com/statistics/435907/e-commerce-revenue-share-of-companies-by-country-europe/

Leave a Reply